In the age of digital marketing and viral social media posts, managing your company’s reputation has never required a faster response, and even if you manage to respond to a crisis promptly, damage can still spread quickly. The result can be devastating financial losses for your company.

Fortunately, there is insurance out there known as Reputation Risk Insurance that covers businesses against financial loss proven to be the result of a damaged reputation. Since bad rumours and privacy breaches that affect a company spread like wildfire these days, often leading to a public relations crisis, it’s important to ensure you protect your business by obtaining Reputational Risk Insurance.

Before we take a look at what that means, first let’s examine the types of things that can damage a company’s reputation:

1. Bad press involving employees

It’s not something a business owner ever wants to deal with, but scandals involving employees happen on a regular basis, and often come as a complete surprise. They range from employees acting badly, to employees turning on the company and using the media to expose its wrongdoings.

When problems in a company arise due to issues with employees, it makes for great media bait and the fallout can sometimes last for months or years. While it happens in Hollywood and in politics all the time, these sorts of scandals also effect businesses, and if it gets really bad, the reputation of your business becomes compromised and sales may drop.

2. Bad press involving customers

A lot of the time your company can become the subject of bad press based on the words and actions of your customers. Situations such as these may include you being falsely accused of running a scam, having a faulty product, harming a customer and being sued, and so on. They usually lead to negative reviews of your business that, if you’re unlucky enough, go viral, tarnishing your reputation. While the dip in business may be temporary, it could be drastic nonetheless.

3. Privacy Breaches

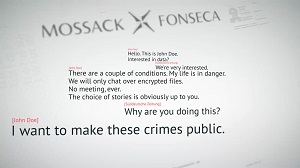

Another reason businesses make massive headlines is whenever they experience a privacy breach, a.k.a, whenever they get hacked. When word gets out that a company can’t manage to hold onto its customers’ private information, that company’s overall reputation takes a nosedive. The two best recent examples of this are the Ashley Madison scandal of 2015, the Sony hacks, and the Panama Papers leak of sensitive emails and documents from the Panama law firm, Mossack Fonesca.

These highly publicized privacy breaches could have tanked each of these companies, but instead they live on.

4. Product recalls

You might often wonder how some businesses manage to bounce back after having to recall, in some cases, hundreds of thousands of products. This happens a lot in the food and beverage industry, as well as the automotive industry (an immediate example is the Volkswagen Emissions Recall, but there are plenty of other instances that don’t ever reach the mainstream media’s attention.

Product recalls can harm your company’s reputation but in most cases don’t cause a total shutdown. Ever wonder who pays for the expenses of product recalls? Yep, most likely it’s insurance policies.

In all of the cases above, the theory “there is no such thing as bad publicity” may come into play. It is possibly that these companies rose above their PR disasters by sheer determination, but it’s much more likely that Reputational Risk Insurance had a lot to do with helping each of these companies stay afloat during tough times.

How to Obtain Reputational Risk Insurance

If you own a nationally or globally recognized businesses, it’s important to insure it against PR disasters. A relatively new insurance on the block, Reputational Risk Insurance does just that, either as a part of an existing policy or as a stand-alone policy.

As Part of An Existing Policy

Up until recently, Reputational Risk Insurance was only available as a built-in component of your overall business insurance package (packaged coverage). Depending on the size of your business and the type of insurance you have, it’s likely your business insurance already covers you up to a certain point for Reputational Risk Insurance under the terminology “crisis management endorsement.”

A big bonus of having this type of insurance in an existing policy is that crisis management endorsements are completely customizable to the needs of a business. For example, a company with a lot of SKUs would want insurance specifically protecting it against product recalls, whereas an oil & gas company would opt for a strong insurance policy for things like environmental disasters, which would likely result in significantly bad press. On a similar note, a tech company would want a policy protecting it specifically from fallout and loss of business due to cyber-attacks.

As a Stand-alone Policy

More and more, Reputational Risk Insurance is becoming its own entity as a stand-alone policy, which often means heftier premiums. The beauty of the stand-alone policies are that they offer broader coverage than policies that come in a pre-existing package. Because of their high premiums and broad coverage, stand-alone policies are mostly suitable for large corporations. An experienced business insurance broker will be able to help you determine which option is right for you.

What Does Reputational Risk Insurance Cover?

Proving that a loss of business occurred strictly as a result of a damaged reputation is difficult to quantify. For example, could the loss be attributed to other things, like a dip in the economy, or the introduction of an inferior product offering? This complication means this type of insurance is still relatively new, with detailed plans and coverage amounts constantly in-flux. Generally speaking, depending on the language of your policy, your reputation risk insurance can either cover: losses only, PR crisis management only, or a combination of the two.

Losses Only

Losses to be covered must be attributed to a reason that shows up in the policy’s stated reputation risk list. Providers and adjusters must research the exact amount of compensation allowable, often basing it on the responses they get from surveyed customers. They don’t take your word for it!

Crisis Management Expenses Only

For non-profit businesses crisis management expenses coverage might be all that is needed. Crisis management expenses can include covering the cost of consulting with a team of public relations experts who can help prepare positive-natured press releases and advertisements.

A Combination of Both Losses and Crisis Management Expenses

The gold standard of Reputational Risk Insurance coverage, this option covers a business for both losses and crisis management expenses.

Reputational Risk Insurance is a confusing subject not easily summed up in one blog post. On top of that, it is not a common type of insurance, so it’s not offered through just any broker, but you should still be able to shop around for a few different quotes.

At SeaFirst Insurance Brokers in Victoria, BC, our brokers are available to help you navigate through the language of business insurance, including reputational risk insurance. We look at the whole picture, ask you the right questions, and provide coverage that’s as comprehensive and unique as your needs.

Ensuring the survival and continued success of your business after a loss is our specialty. SeaFirst Insurance has many offices in the Greater Victoria BC area, and we can help meet your needs whether you’re a small business owner, owner of multiple locations, or even a large corporation. Contact us and let us help you realize the safeguards of reputational risk insurance today!